Skip to content

Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University

Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University Read MoreThanksgiving at the Tappletons’

Read MoreThanksgiving at the Tappletons’ Read MoreTaxmann’s Essentials Combo for Direct Tax Laws | Income Tax Act, Income Tax Rules & Direct Taxes Ready Reckoner | Finance Act 2023 | A.Y. 2023-24 & 2024-25

Read MoreTaxmann’s Essentials Combo for Direct Tax Laws | Income Tax Act, Income Tax Rules & Direct Taxes Ready Reckoner | Finance Act 2023 | A.Y. 2023-24 & 2024-25 Read MoreIncome Tax Guidelines and Mini Ready Reckoner 2022-23 and 2023-24 Alongwith Tax Planning

Read MoreIncome Tax Guidelines and Mini Ready Reckoner 2022-23 and 2023-24 Alongwith Tax Planning Read MoreTaxmann’s Trusts & NGOs Ready Reckoner – Practical commentary on the tax implications during the life cycle of Charitable Trusts & NGOs with various tutorials & guides [Finance Act 2023 Edition]

Read MoreTaxmann’s Trusts & NGOs Ready Reckoner – Practical commentary on the tax implications during the life cycle of Charitable Trusts & NGOs with various tutorials & guides [Finance Act 2023 Edition] Read MoreCommercial Direct Taxes Ready Reckoner with Tax Planning (With FREE E-Book Access) By Dr. Girish Ahuja Dr. Ravi Gupta Edition March 2023 [Paperback] COMMERCIAL’S

Read MoreCommercial Direct Taxes Ready Reckoner with Tax Planning (With FREE E-Book Access) By Dr. Girish Ahuja Dr. Ravi Gupta Edition March 2023 [Paperback] COMMERCIAL’S Read MoreTaxmann’s GST Ready Reckoner [CGST_IGST (Amdt.) Act 2023] – Most trusted ready referencer for all provisions of the GST Law with GST Case Laws, GST Notifications, GST Circulars, etc.

Read MoreTaxmann’s GST Ready Reckoner [CGST_IGST (Amdt.) Act 2023] – Most trusted ready referencer for all provisions of the GST Law with GST Case Laws, GST Notifications, GST Circulars, etc. Read MoreLexis Nexis’s, Income Tax Law (Vol.- 1 To 5) By Chaturvedi & Pithisaria – 8th Edition 2024

Read MoreLexis Nexis’s, Income Tax Law (Vol.- 1 To 5) By Chaturvedi & Pithisaria – 8th Edition 2024 Read MorePW CA Intermediate Group 1 Income Tax, Goods and Services Tax Combo Set of 2 Books Latest Syllabus | Applicable for November 2024 Exam Onwards

Read MorePW CA Intermediate Group 1 Income Tax, Goods and Services Tax Combo Set of 2 Books Latest Syllabus | Applicable for November 2024 Exam Onwards Read MoreYellowstone: The Official Dutton Ranch Family Cookbook Gift Set: Plus Exclusive Apron

Read MoreYellowstone: The Official Dutton Ranch Family Cookbook Gift Set: Plus Exclusive Apron Read MoreTaxmann’s Analysis | Changes Introduced in New ITR Forms 1 and 4 Notified for Assessment Year 2024-25

Read MoreTaxmann’s Analysis | Changes Introduced in New ITR Forms 1 and 4 Notified for Assessment Year 2024-25 Read MoreTAXPUB CA, CS, CMA, PROFESSIONAL DIARY (2024) by TAX PUBLISHERS

Read MoreTAXPUB CA, CS, CMA, PROFESSIONAL DIARY (2024) by TAX PUBLISHERS Read MoreTaxmann’s Law Relating to Search & Seizure – Comprehensive Commentary along with Case Laws on Search & Seizure, FAQs, Checklists, etc. [Finance Act 2023 Edition]

Read MoreTaxmann’s Law Relating to Search & Seizure – Comprehensive Commentary along with Case Laws on Search & Seizure, FAQs, Checklists, etc. [Finance Act 2023 Edition] Read MoreGST Acts Bare Act – Latest 2024 EDITION Professional’s

Read MoreGST Acts Bare Act – Latest 2024 EDITION Professional’s Read MoreTaxmann’s Deduction of Tax at Source (TDS_TCS) with Advance Tax & Refunds – Guidance on practical problems supported by Illustrations, Case Law, Legal Jurisprudence, etc. [Finance Act 2023]

Read MoreTaxmann’s Deduction of Tax at Source (TDS_TCS) with Advance Tax & Refunds – Guidance on practical problems supported by Illustrations, Case Law, Legal Jurisprudence, etc. [Finance Act 2023] Read MoreProfessional’s न्यू क्रिमिनल लॉज़ क्रिमिनल मेजर एक्ट्स भारतीय न्याय संहिता, 2023, भारतीय नागरिक सुरक्षा संहिता, 2023, भारतीय साक्ष्य अधिनियम, 2023, क्रिमिनल मैन्युअल हिंदी संस्करण, w.e.f 1-7-2024 Notification Incorporated

Read MoreProfessional’s न्यू क्रिमिनल लॉज़ क्रिमिनल मेजर एक्ट्स भारतीय न्याय संहिता, 2023, भारतीय नागरिक सुरक्षा संहिता, 2023, भारतीय साक्ष्य अधिनियम, 2023, क्रिमिनल मैन्युअल हिंदी संस्करण, w.e.f 1-7-2024 Notification Incorporated Read MoreTaxmann’s Guidance Note | Shift of GST Liability from Restaurants to Food Aggregators from 1st January 2022 on the Supply of ‘Restaurant Services’

Read MoreTaxmann’s Guidance Note | Shift of GST Liability from Restaurants to Food Aggregators from 1st January 2022 on the Supply of ‘Restaurant Services’ Read MoreBharat Direct Taxes Ready Reckoner With Tax Planning (With FREE E-Book Access) By Mahendra B. Gabhawala Edition March 2023 [Paperback] BHARAT

Read MoreBharat Direct Taxes Ready Reckoner With Tax Planning (With FREE E-Book Access) By Mahendra B. Gabhawala Edition March 2023 [Paperback] BHARAT Read MoreDisney Manga: Tim Burton’s The Nightmare Before Christmas – Zero’s Journey (Ultimate Manga Edition)

Read MoreDisney Manga: Tim Burton’s The Nightmare Before Christmas – Zero’s Journey (Ultimate Manga Edition) Read More2023 Remote Pilot Test Prep: Study and prepare for your remote pilot FAA Knowledge Exam (ASA Test Prep Series)

Read More2023 Remote Pilot Test Prep: Study and prepare for your remote pilot FAA Knowledge Exam (ASA Test Prep Series) Read MoreTaxmann’s Students’ Guide to Income Tax | University Edition – The bridge between theory & application, in simple language, with explanation in a step-by-step manner | Finance Act 2022 | A.Y. 2022-23

Read MoreTaxmann’s Students’ Guide to Income Tax | University Edition – The bridge between theory & application, in simple language, with explanation in a step-by-step manner | Finance Act 2022 | A.Y. 2022-23 Read MoreNew Fundamentals of Income Tax | 64th Edition | A.Y. 2023-24 | For Semester Vth of Kerala University

Read MoreNew Fundamentals of Income Tax | 64th Edition | A.Y. 2023-24 | For Semester Vth of Kerala University Read MoreTaxmann’s PIO’s Guide to RTI – Based on 1,00,000 categorised orders from the CIC & Courts, provides insights into the RTI Act’s nuances, implementation, and strategies to counteract misuse

Read MoreTaxmann’s PIO’s Guide to RTI – Based on 1,00,000 categorised orders from the CIC & Courts, provides insights into the RTI Act’s nuances, implementation, and strategies to counteract misuse Read MoreDirect Taxes Ready Reckoner

Read MoreDirect Taxes Ready Reckoner Read MoreDIRECT TAXES READY RECKONER

Read MoreDIRECT TAXES READY RECKONER Read MoreCommercial’s The Bharatiya Nyaya Suraksha Sanhita, 2024 – New Criminal Law Edition Paperback – 1 January 2024

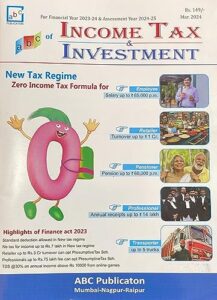

Read MoreCommercial’s The Bharatiya Nyaya Suraksha Sanhita, 2024 – New Criminal Law Edition Paperback – 1 January 2024 Read MoreIncome Tax and Investment March 2024 – New Tex Regime Zero Income Tex Formula (For Financial Year 2023-24 & Assesment Year 2024-25)

Read MoreIncome Tax and Investment March 2024 – New Tex Regime Zero Income Tex Formula (For Financial Year 2023-24 & Assesment Year 2024-25) Read MoreTaxmann’s Taxation of Political Donations with How to Respond to Notices Concerning Bogus Political Donations – Comprehensive guidance with checklists, do’s & don’ts, case studies, etc.

Read MoreTaxmann’s Taxation of Political Donations with How to Respond to Notices Concerning Bogus Political Donations – Comprehensive guidance with checklists, do’s & don’ts, case studies, etc. Read MoreTaxmann’s Tax Audit – Clause-wise detailed commentary on Tax Audit, Presumptive Tax, ICDS with Tax Audit Ready Reckoner, Checklists, Case Laws, Views of the ICAI, etc. | Finance Act 2023

Read MoreTaxmann’s Tax Audit – Clause-wise detailed commentary on Tax Audit, Presumptive Tax, ICDS with Tax Audit Ready Reckoner, Checklists, Case Laws, Views of the ICAI, etc. | Finance Act 2023 Read MorePRACTICE SPECIFIC INCOME TAX COMMENTARY (2023)(SET OF 2 VOLUMES) by TAX PUBLISHERS

Read MorePRACTICE SPECIFIC INCOME TAX COMMENTARY (2023)(SET OF 2 VOLUMES) by TAX PUBLISHERS Read MoreCOMPANY FINANCIAL STATEMENTS AND AUDIT (2023) by TAX PUBLISHERS

Read MoreCOMPANY FINANCIAL STATEMENTS AND AUDIT (2023) by TAX PUBLISHERS Read MoreTaxmann’s TDS Ready Reckoner – Covering detailed analysis on provisions of TDS & TCS along with Alphabetical TDS Reckoner, TDS Charts, Illustrations, etc. [Finance Act 2023]

Read MoreTaxmann’s TDS Ready Reckoner – Covering detailed analysis on provisions of TDS & TCS along with Alphabetical TDS Reckoner, TDS Charts, Illustrations, etc. [Finance Act 2023] Read MoreV G Mehta’s Income-tax Ready Reckoner 2020-21

Read MoreV G Mehta’s Income-tax Ready Reckoner 2020-21 Read MoreIncome Tax Law & Accounts A.Y. 2023-24 For B.Com Vth Semester of Calicut University & B.Com (Hons.) IIIrd Year of Babasaheb Bhimrao Ambedkar Bihar University Muzaffarpur

Read MoreIncome Tax Law & Accounts A.Y. 2023-24 For B.Com Vth Semester of Calicut University & B.Com (Hons.) IIIrd Year of Babasaheb Bhimrao Ambedkar Bihar University Muzaffarpur Read MoreCommercial’s Systematics Approach to Income Tax – 43_edition, 2021-22

Read MoreCommercial’s Systematics Approach to Income Tax – 43_edition, 2021-22 Read MoreINCOME TAX for B.Com 2023-24

Read MoreINCOME TAX for B.Com 2023-24 Read MoreTaxmann’s Principles of Benami Law – Comprehensive treatise on benami law covering its various aspects, relationships with related enactments, the applicability of evidence rules, etc.

Read MoreTaxmann’s Principles of Benami Law – Comprehensive treatise on benami law covering its various aspects, relationships with related enactments, the applicability of evidence rules, etc. Read MoreTaxmann’s TDS on Benefits or Perquisites under Section 194R – Unique compliance-oriented & legal approach featuring illustrative case studies, FAQs, ready reckoners, etc.

Read MoreTaxmann’s TDS on Benefits or Perquisites under Section 194R – Unique compliance-oriented & legal approach featuring illustrative case studies, FAQs, ready reckoners, etc. Read MorePICSO 2024 Executive Style Quality Diary with Excellent Design,Sunday Full Page Regular Diary RULED 365 Pages (Multicolor)

Read MorePICSO 2024 Executive Style Quality Diary with Excellent Design,Sunday Full Page Regular Diary RULED 365 Pages (Multicolor) Read MoreR.K. Jain’s Foreign Trade Policy 2023 – Authentic Coverage of FTP 2023, Ready Reckoner, Handbook of Procedures & Appendices, New Aayat-Niryat Form, Notifications, Allied Act & Rules

Read MoreR.K. Jain’s Foreign Trade Policy 2023 – Authentic Coverage of FTP 2023, Ready Reckoner, Handbook of Procedures & Appendices, New Aayat-Niryat Form, Notifications, Allied Act & Rules

Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University

Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University

Read MoreIncome Tax Law & Accounts A.Y 2023-24 For B.Com VI Semester of Lucknow University Read MoreThanksgiving at the Tappletons’

Read MoreThanksgiving at the Tappletons’ Read MoreTaxmann’s Essentials Combo for Direct Tax Laws | Income Tax Act, Income Tax Rules & Direct Taxes Ready Reckoner | Finance Act 2023 | A.Y. 2023-24 & 2024-25

Read MoreTaxmann’s Essentials Combo for Direct Tax Laws | Income Tax Act, Income Tax Rules & Direct Taxes Ready Reckoner | Finance Act 2023 | A.Y. 2023-24 & 2024-25 Read MoreIncome Tax Guidelines and Mini Ready Reckoner 2022-23 and 2023-24 Alongwith Tax Planning

Read MoreIncome Tax Guidelines and Mini Ready Reckoner 2022-23 and 2023-24 Alongwith Tax Planning Read MoreTaxmann’s Trusts & NGOs Ready Reckoner – Practical commentary on the tax implications during the life cycle of Charitable Trusts & NGOs with various tutorials & guides [Finance Act 2023 Edition]

Read MoreTaxmann’s Trusts & NGOs Ready Reckoner – Practical commentary on the tax implications during the life cycle of Charitable Trusts & NGOs with various tutorials & guides [Finance Act 2023 Edition] Read MoreCommercial Direct Taxes Ready Reckoner with Tax Planning (With FREE E-Book Access) By Dr. Girish Ahuja Dr. Ravi Gupta Edition March 2023 [Paperback] COMMERCIAL’S

Read MoreCommercial Direct Taxes Ready Reckoner with Tax Planning (With FREE E-Book Access) By Dr. Girish Ahuja Dr. Ravi Gupta Edition March 2023 [Paperback] COMMERCIAL’S Read MoreTaxmann’s GST Ready Reckoner [CGST_IGST (Amdt.) Act 2023] – Most trusted ready referencer for all provisions of the GST Law with GST Case Laws, GST Notifications, GST Circulars, etc.

Read MoreTaxmann’s GST Ready Reckoner [CGST_IGST (Amdt.) Act 2023] – Most trusted ready referencer for all provisions of the GST Law with GST Case Laws, GST Notifications, GST Circulars, etc. Read MoreLexis Nexis’s, Income Tax Law (Vol.- 1 To 5) By Chaturvedi & Pithisaria – 8th Edition 2024

Read MoreLexis Nexis’s, Income Tax Law (Vol.- 1 To 5) By Chaturvedi & Pithisaria – 8th Edition 2024 Read MorePW CA Intermediate Group 1 Income Tax, Goods and Services Tax Combo Set of 2 Books Latest Syllabus | Applicable for November 2024 Exam Onwards

Read MorePW CA Intermediate Group 1 Income Tax, Goods and Services Tax Combo Set of 2 Books Latest Syllabus | Applicable for November 2024 Exam Onwards Read MoreYellowstone: The Official Dutton Ranch Family Cookbook Gift Set: Plus Exclusive Apron

Read MoreYellowstone: The Official Dutton Ranch Family Cookbook Gift Set: Plus Exclusive Apron Read MoreTaxmann’s Analysis | Changes Introduced in New ITR Forms 1 and 4 Notified for Assessment Year 2024-25

Read MoreTaxmann’s Analysis | Changes Introduced in New ITR Forms 1 and 4 Notified for Assessment Year 2024-25 Read MoreTAXPUB CA, CS, CMA, PROFESSIONAL DIARY (2024) by TAX PUBLISHERS

Read MoreTAXPUB CA, CS, CMA, PROFESSIONAL DIARY (2024) by TAX PUBLISHERS Read MoreTaxmann’s Law Relating to Search & Seizure – Comprehensive Commentary along with Case Laws on Search & Seizure, FAQs, Checklists, etc. [Finance Act 2023 Edition]

Read MoreTaxmann’s Law Relating to Search & Seizure – Comprehensive Commentary along with Case Laws on Search & Seizure, FAQs, Checklists, etc. [Finance Act 2023 Edition] Read MoreGST Acts Bare Act – Latest 2024 EDITION Professional’s

Read MoreGST Acts Bare Act – Latest 2024 EDITION Professional’s Read MoreTaxmann’s Deduction of Tax at Source (TDS_TCS) with Advance Tax & Refunds – Guidance on practical problems supported by Illustrations, Case Law, Legal Jurisprudence, etc. [Finance Act 2023]

Read MoreTaxmann’s Deduction of Tax at Source (TDS_TCS) with Advance Tax & Refunds – Guidance on practical problems supported by Illustrations, Case Law, Legal Jurisprudence, etc. [Finance Act 2023] Read MoreProfessional’s न्यू क्रिमिनल लॉज़ क्रिमिनल मेजर एक्ट्स भारतीय न्याय संहिता, 2023, भारतीय नागरिक सुरक्षा संहिता, 2023, भारतीय साक्ष्य अधिनियम, 2023, क्रिमिनल मैन्युअल हिंदी संस्करण, w.e.f 1-7-2024 Notification Incorporated

Read MoreProfessional’s न्यू क्रिमिनल लॉज़ क्रिमिनल मेजर एक्ट्स भारतीय न्याय संहिता, 2023, भारतीय नागरिक सुरक्षा संहिता, 2023, भारतीय साक्ष्य अधिनियम, 2023, क्रिमिनल मैन्युअल हिंदी संस्करण, w.e.f 1-7-2024 Notification Incorporated Read MoreTaxmann’s Guidance Note | Shift of GST Liability from Restaurants to Food Aggregators from 1st January 2022 on the Supply of ‘Restaurant Services’

Read MoreTaxmann’s Guidance Note | Shift of GST Liability from Restaurants to Food Aggregators from 1st January 2022 on the Supply of ‘Restaurant Services’ Read MoreBharat Direct Taxes Ready Reckoner With Tax Planning (With FREE E-Book Access) By Mahendra B. Gabhawala Edition March 2023 [Paperback] BHARAT

Read MoreBharat Direct Taxes Ready Reckoner With Tax Planning (With FREE E-Book Access) By Mahendra B. Gabhawala Edition March 2023 [Paperback] BHARAT Read MoreDisney Manga: Tim Burton’s The Nightmare Before Christmas – Zero’s Journey (Ultimate Manga Edition)

Read MoreDisney Manga: Tim Burton’s The Nightmare Before Christmas – Zero’s Journey (Ultimate Manga Edition) Read More2023 Remote Pilot Test Prep: Study and prepare for your remote pilot FAA Knowledge Exam (ASA Test Prep Series)

Read More2023 Remote Pilot Test Prep: Study and prepare for your remote pilot FAA Knowledge Exam (ASA Test Prep Series) Read MoreTaxmann’s Students’ Guide to Income Tax | University Edition – The bridge between theory & application, in simple language, with explanation in a step-by-step manner | Finance Act 2022 | A.Y. 2022-23

Read MoreTaxmann’s Students’ Guide to Income Tax | University Edition – The bridge between theory & application, in simple language, with explanation in a step-by-step manner | Finance Act 2022 | A.Y. 2022-23 Read MoreNew Fundamentals of Income Tax | 64th Edition | A.Y. 2023-24 | For Semester Vth of Kerala University

Read MoreNew Fundamentals of Income Tax | 64th Edition | A.Y. 2023-24 | For Semester Vth of Kerala University Read MoreTaxmann’s PIO’s Guide to RTI – Based on 1,00,000 categorised orders from the CIC & Courts, provides insights into the RTI Act’s nuances, implementation, and strategies to counteract misuse

Read MoreTaxmann’s PIO’s Guide to RTI – Based on 1,00,000 categorised orders from the CIC & Courts, provides insights into the RTI Act’s nuances, implementation, and strategies to counteract misuse Read MoreDirect Taxes Ready Reckoner

Read MoreDirect Taxes Ready Reckoner Read MoreDIRECT TAXES READY RECKONER

Read MoreDIRECT TAXES READY RECKONER Read MoreCommercial’s The Bharatiya Nyaya Suraksha Sanhita, 2024 – New Criminal Law Edition Paperback – 1 January 2024

Read MoreCommercial’s The Bharatiya Nyaya Suraksha Sanhita, 2024 – New Criminal Law Edition Paperback – 1 January 2024 Read MoreIncome Tax and Investment March 2024 – New Tex Regime Zero Income Tex Formula (For Financial Year 2023-24 & Assesment Year 2024-25)

Read MoreIncome Tax and Investment March 2024 – New Tex Regime Zero Income Tex Formula (For Financial Year 2023-24 & Assesment Year 2024-25) Read MoreTaxmann’s Taxation of Political Donations with How to Respond to Notices Concerning Bogus Political Donations – Comprehensive guidance with checklists, do’s & don’ts, case studies, etc.

Read MoreTaxmann’s Taxation of Political Donations with How to Respond to Notices Concerning Bogus Political Donations – Comprehensive guidance with checklists, do’s & don’ts, case studies, etc. Read MoreTaxmann’s Tax Audit – Clause-wise detailed commentary on Tax Audit, Presumptive Tax, ICDS with Tax Audit Ready Reckoner, Checklists, Case Laws, Views of the ICAI, etc. | Finance Act 2023

Read MoreTaxmann’s Tax Audit – Clause-wise detailed commentary on Tax Audit, Presumptive Tax, ICDS with Tax Audit Ready Reckoner, Checklists, Case Laws, Views of the ICAI, etc. | Finance Act 2023 Read MorePRACTICE SPECIFIC INCOME TAX COMMENTARY (2023)(SET OF 2 VOLUMES) by TAX PUBLISHERS

Read MorePRACTICE SPECIFIC INCOME TAX COMMENTARY (2023)(SET OF 2 VOLUMES) by TAX PUBLISHERS Read MoreCOMPANY FINANCIAL STATEMENTS AND AUDIT (2023) by TAX PUBLISHERS

Read MoreCOMPANY FINANCIAL STATEMENTS AND AUDIT (2023) by TAX PUBLISHERS Read MoreTaxmann’s TDS Ready Reckoner – Covering detailed analysis on provisions of TDS & TCS along with Alphabetical TDS Reckoner, TDS Charts, Illustrations, etc. [Finance Act 2023]

Read MoreTaxmann’s TDS Ready Reckoner – Covering detailed analysis on provisions of TDS & TCS along with Alphabetical TDS Reckoner, TDS Charts, Illustrations, etc. [Finance Act 2023] Read MoreV G Mehta’s Income-tax Ready Reckoner 2020-21

Read MoreV G Mehta’s Income-tax Ready Reckoner 2020-21 Read MoreIncome Tax Law & Accounts A.Y. 2023-24 For B.Com Vth Semester of Calicut University & B.Com (Hons.) IIIrd Year of Babasaheb Bhimrao Ambedkar Bihar University Muzaffarpur

Read MoreIncome Tax Law & Accounts A.Y. 2023-24 For B.Com Vth Semester of Calicut University & B.Com (Hons.) IIIrd Year of Babasaheb Bhimrao Ambedkar Bihar University Muzaffarpur Read MoreCommercial’s Systematics Approach to Income Tax – 43_edition, 2021-22

Read MoreCommercial’s Systematics Approach to Income Tax – 43_edition, 2021-22 Read MoreINCOME TAX for B.Com 2023-24

Read MoreINCOME TAX for B.Com 2023-24 Read MoreTaxmann’s Principles of Benami Law – Comprehensive treatise on benami law covering its various aspects, relationships with related enactments, the applicability of evidence rules, etc.

Read MoreTaxmann’s Principles of Benami Law – Comprehensive treatise on benami law covering its various aspects, relationships with related enactments, the applicability of evidence rules, etc. Read MoreTaxmann’s TDS on Benefits or Perquisites under Section 194R – Unique compliance-oriented & legal approach featuring illustrative case studies, FAQs, ready reckoners, etc.

Read MoreTaxmann’s TDS on Benefits or Perquisites under Section 194R – Unique compliance-oriented & legal approach featuring illustrative case studies, FAQs, ready reckoners, etc. Read MorePICSO 2024 Executive Style Quality Diary with Excellent Design,Sunday Full Page Regular Diary RULED 365 Pages (Multicolor)

Read MorePICSO 2024 Executive Style Quality Diary with Excellent Design,Sunday Full Page Regular Diary RULED 365 Pages (Multicolor) Read MoreR.K. Jain’s Foreign Trade Policy 2023 – Authentic Coverage of FTP 2023, Ready Reckoner, Handbook of Procedures & Appendices, New Aayat-Niryat Form, Notifications, Allied Act & Rules

Read MoreR.K. Jain’s Foreign Trade Policy 2023 – Authentic Coverage of FTP 2023, Ready Reckoner, Handbook of Procedures & Appendices, New Aayat-Niryat Form, Notifications, Allied Act & Rules